Streamlining the lending application process

01 November 2022

How NextGen uses Open Banking

What does NextGen do?

NextGen is Australia’s leading technology solution provider to the lending industry, with more than 60 lenders using their electronic lodgement and loan processing platform, ApplyOnline.

With over 1 million transactions a year completed in ApplyOnline, NextGen processes around 98% of all broker-originated mortgages and 7 in 10 Australian mortgages; NextGen makes it their business to know what’s next when it comes to technology. Its mission is to make lending easy by providing lenders, aggregators and brokers with easier and more efficient ways to deliver for their customers.

How does NextGen use Open Banking?

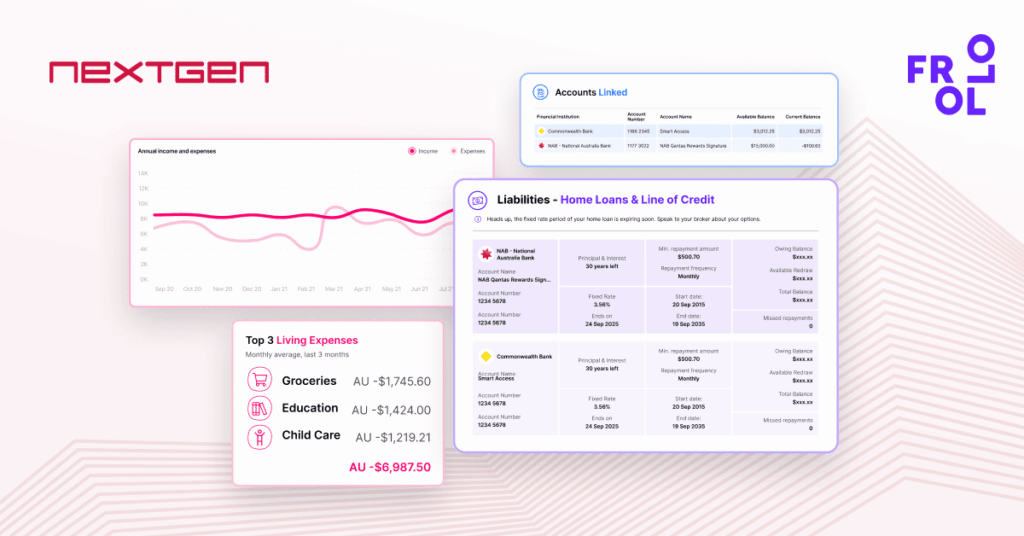

NextGen uses Open banking in its ‘Financial Passport – Open Banking’ service. This service enables mortgage brokers, as Trusted Advisers, to use Open Banking to securely gather client financial data, which can be used to prepare, complete and submit loan applications.

With Open Banking, consumers can securely share their financial information with their chosen service providers to get access to personalised & streamlined products and services or financial advice.

In partnership with leading aggregator Finsure, NextGen will deliver the first Open Banking solution available to mortgage brokers to take advantage of Open Banking data as an integrated part of the home loan application process.

The Financial Passport – Open Banking service is a complimentary service for mortgage brokers and their clients. It provides a regulated, secure and efficient method to streamline the lending application process, improving the speed and accuracy of completing and submitting a loan application and delivering better customer outcomes.

What are the key benefits of Open Banking for NextGen customers?

The Financial Passport – Open Banking service helps mortgage brokers streamline the loan application process. The key benefits are:

- It improves customer engagement by superseding paper-based or digital (e.g. non-secure email or screen-scraped) provisioning of confidential documents such as bank statements and payslips for loan applicants

- It reduces reconciliation and processing time by streamlining bank statement analysis and data entry, via system-to-system integrated services. This increases straight-through processes and reduces cost

- It reduces potential risk and fraud by providing secure, regulated information collection and disclosure