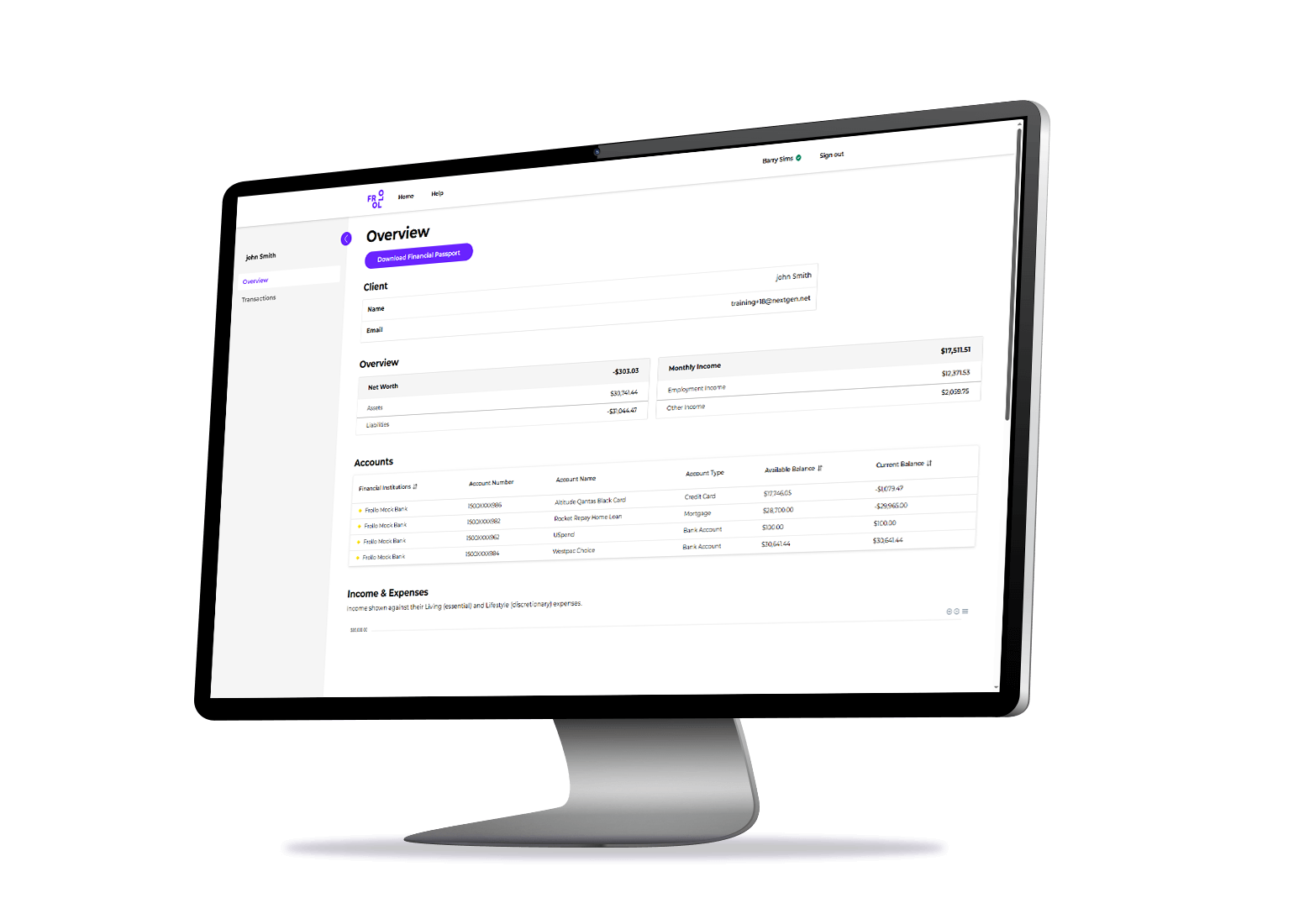

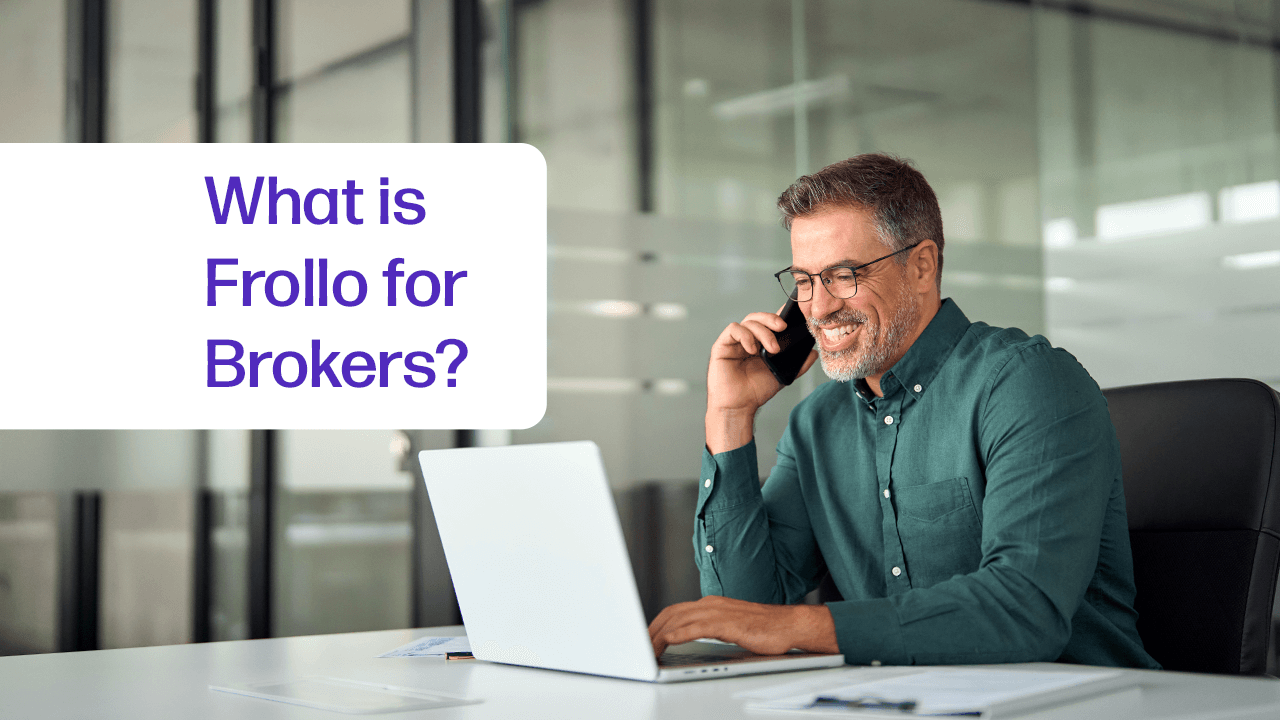

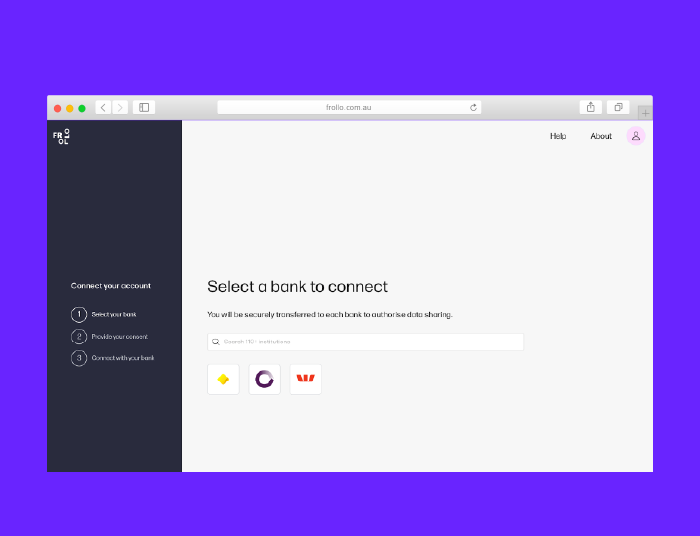

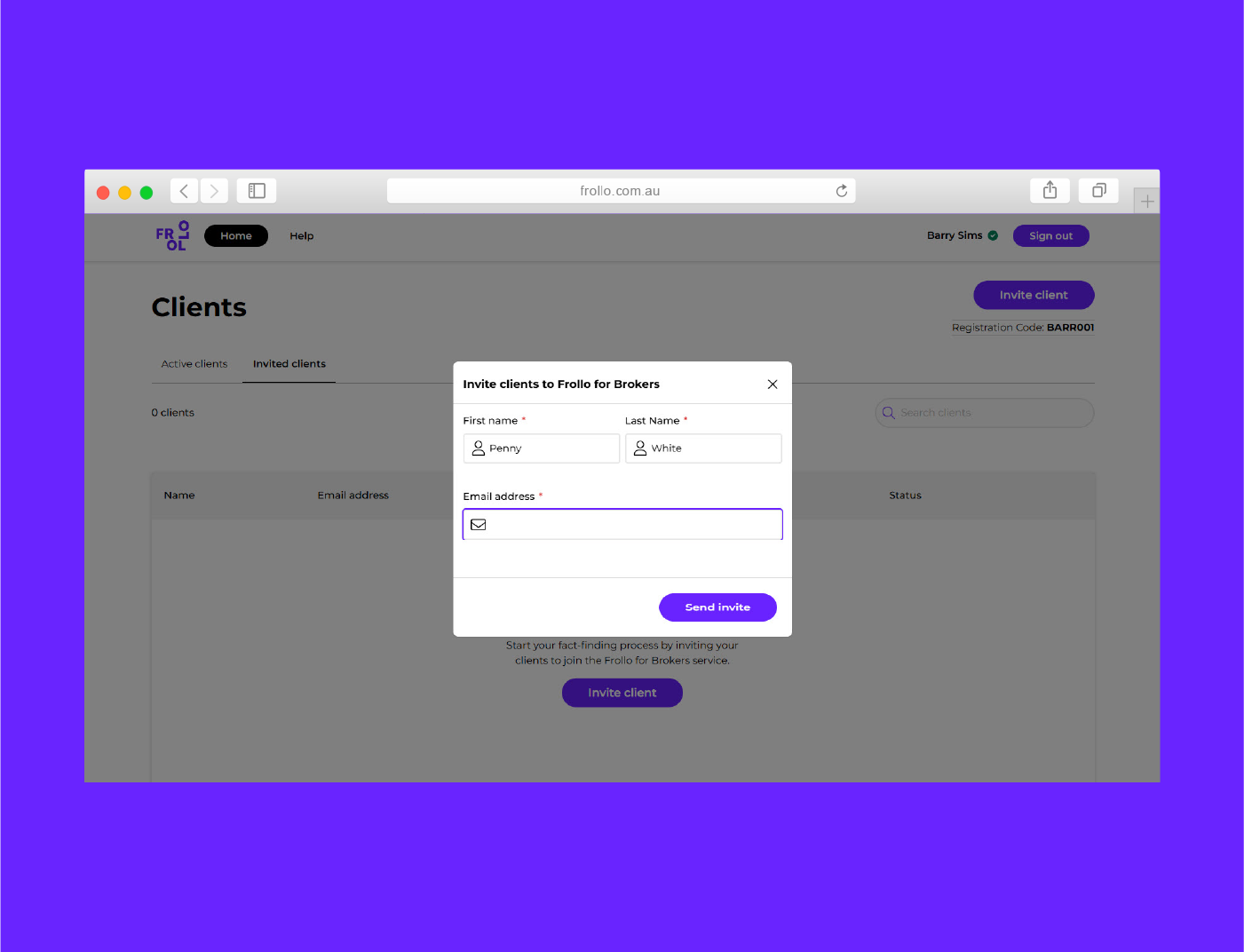

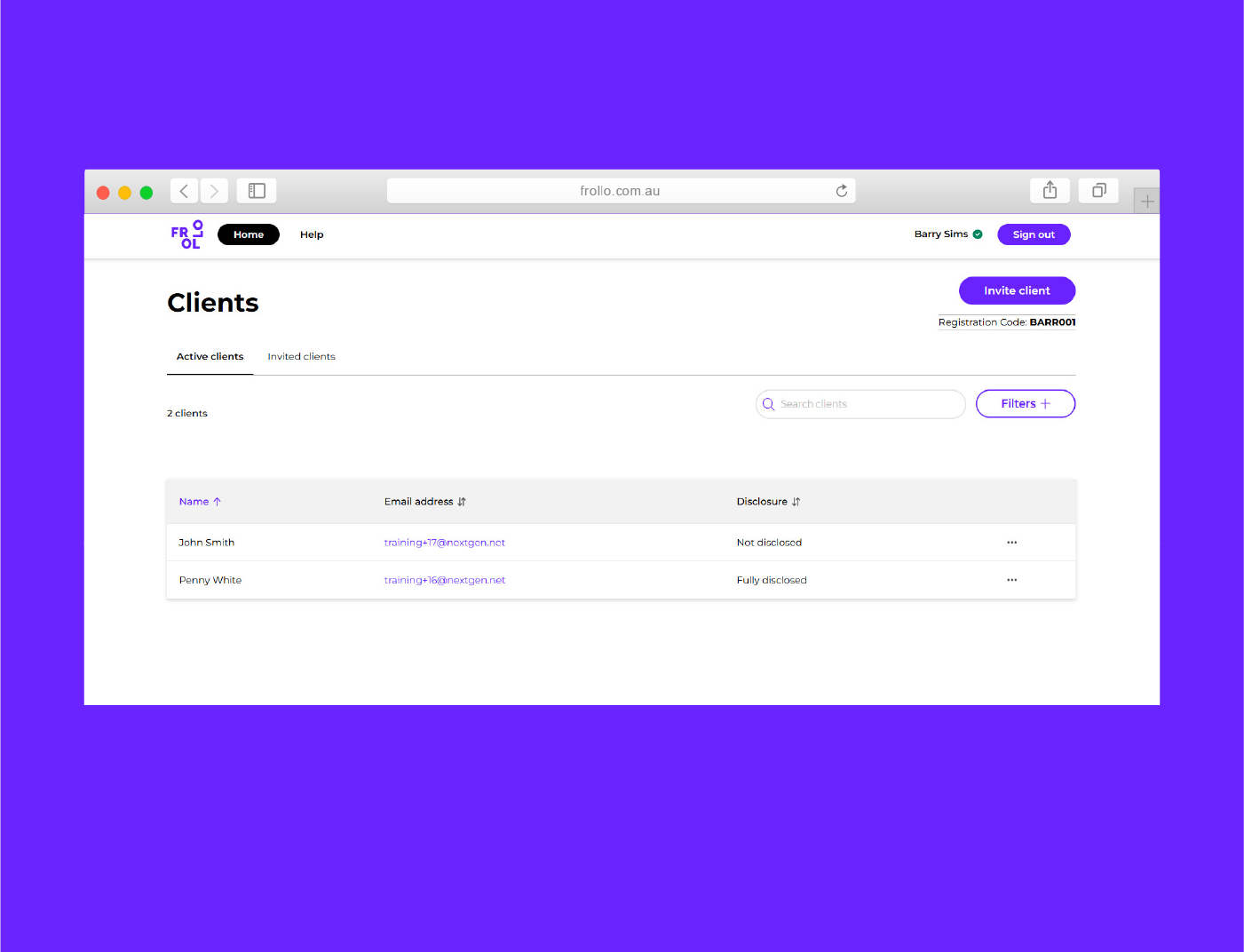

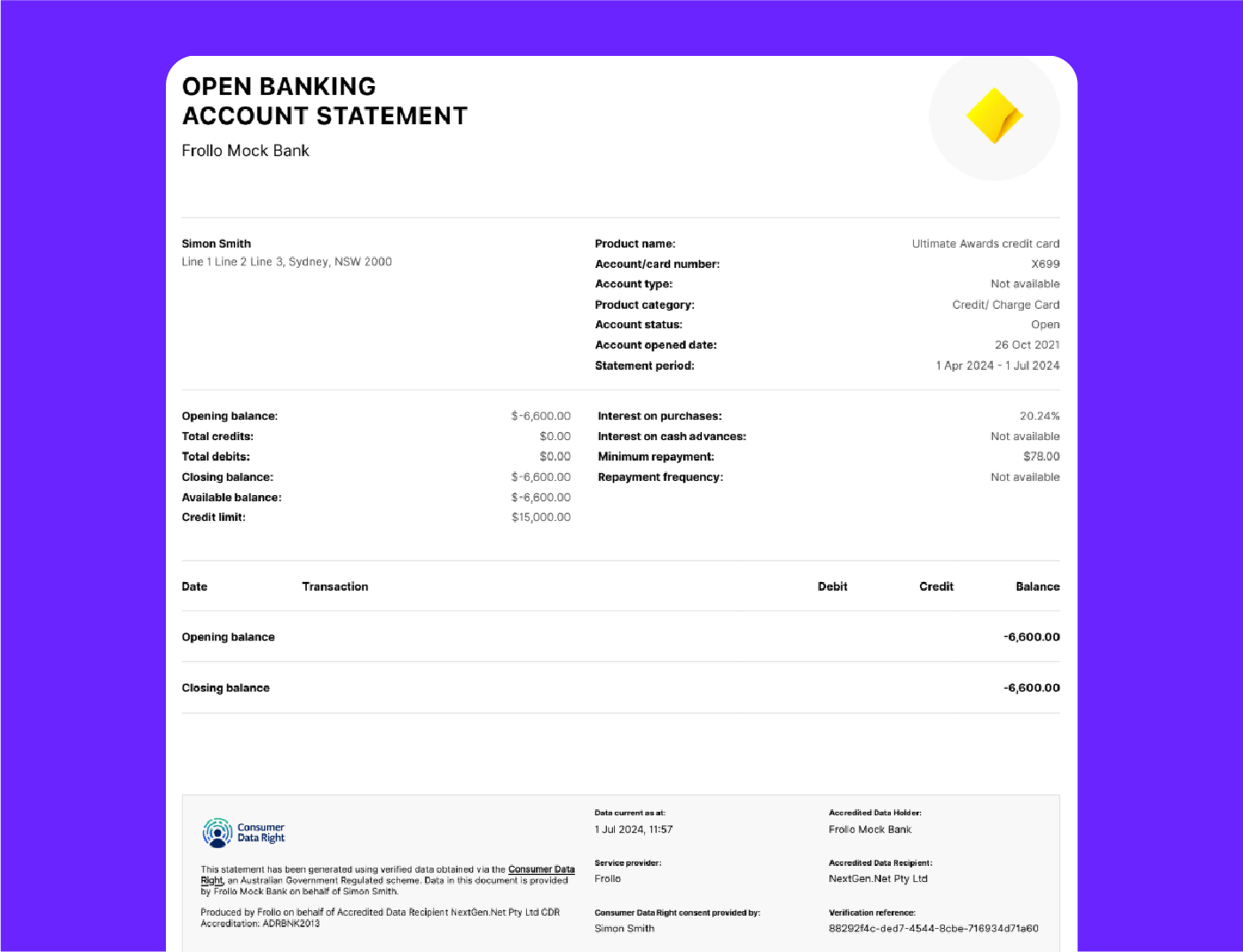

Frollo for Brokers is a free online portal where you can securely receive account statements and financial data from your clients.

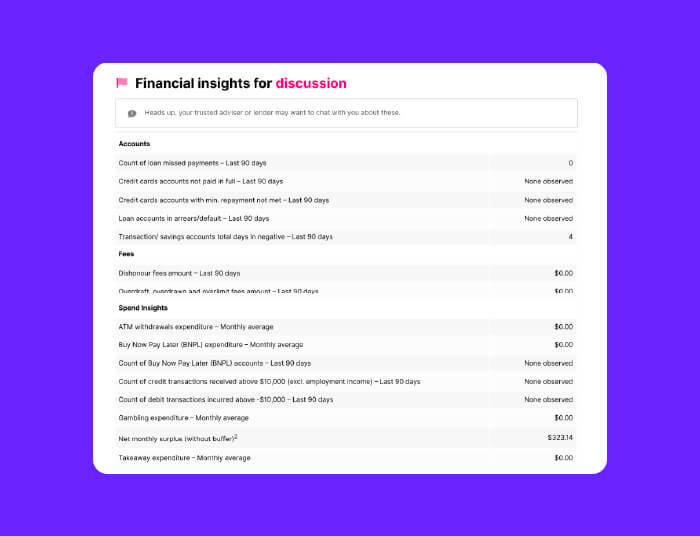

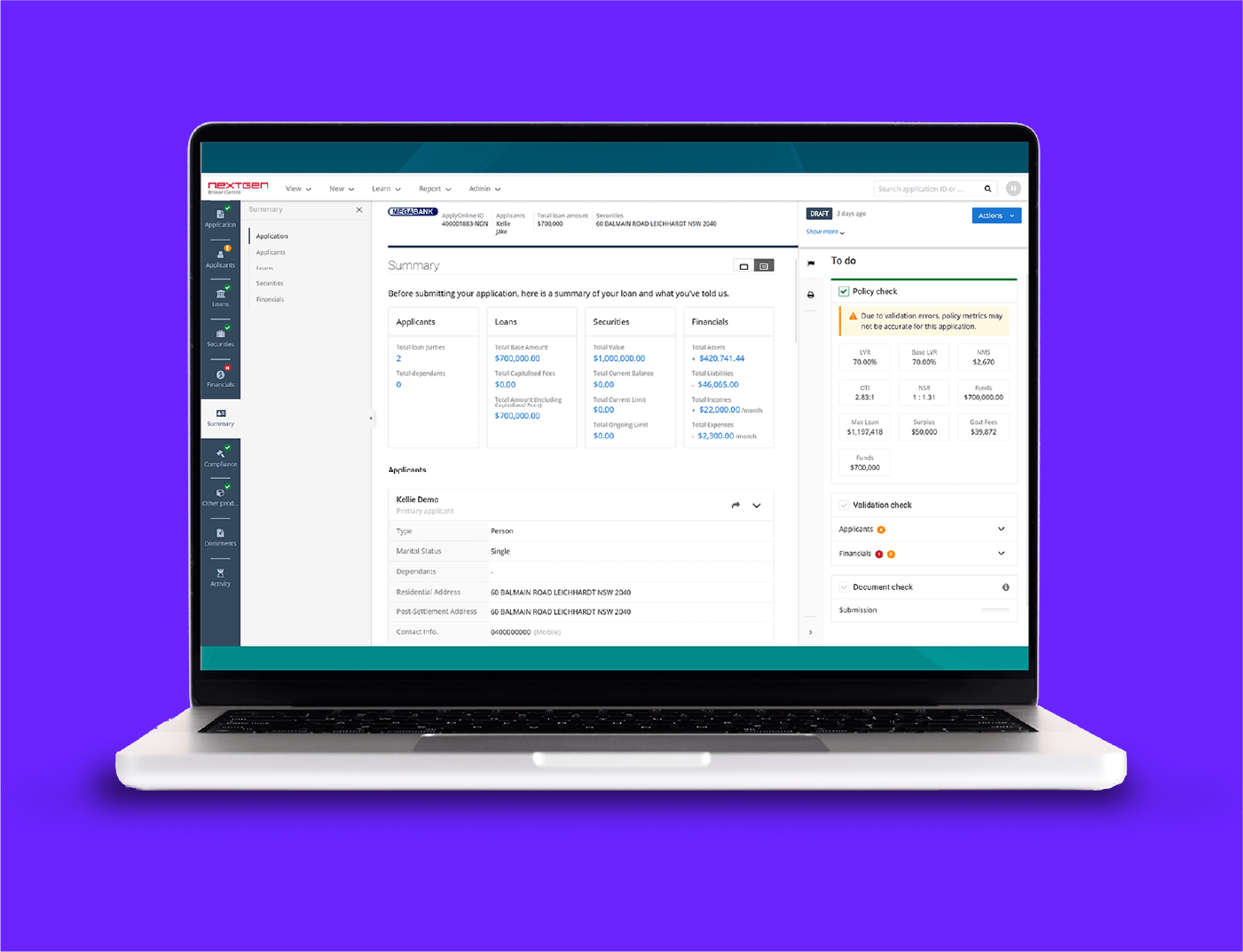

AI powered insights and categorisation with ApplyOnline integration saves time for you and your clients.

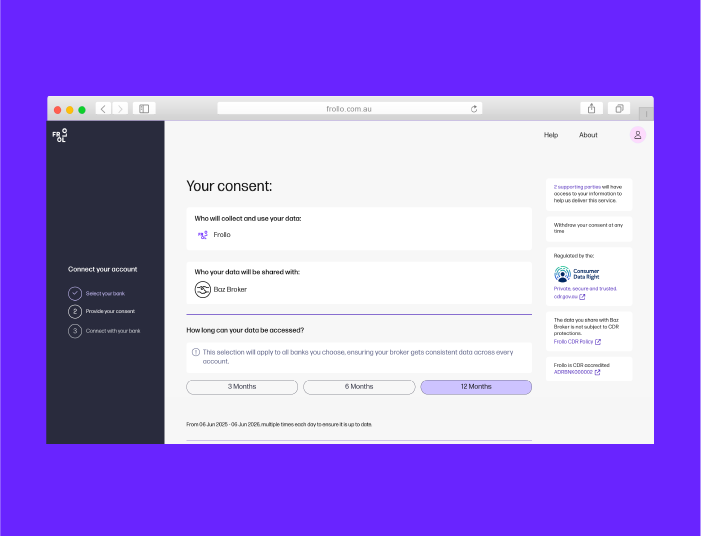

No banking passwords needed – (ever)

Government-regulated Open Banking ensures the most secure process for data collection, without the need for clients to share internet banking passwords