All your finances in one place

01 November 2022

How Beyond Bank uses Open Banking

What does Beyond Bank do?

Beyond Bank is one of the largest, 100% customer-owned mutual banks in the country with a credit union heritage. Their customers are their shareholders, so there are no competing interests. All profits are returned to their customers through better rates, fairer fees, responsible lending, superior customer service and their multi-award-winning internet banking and mobile app.

How does Beyond Bank use Open Banking?

As an accredited Data Recipient (ADR), Beyond Bank can provide its customers with Open Banking powered services, using data their customers share from other financial institutions.

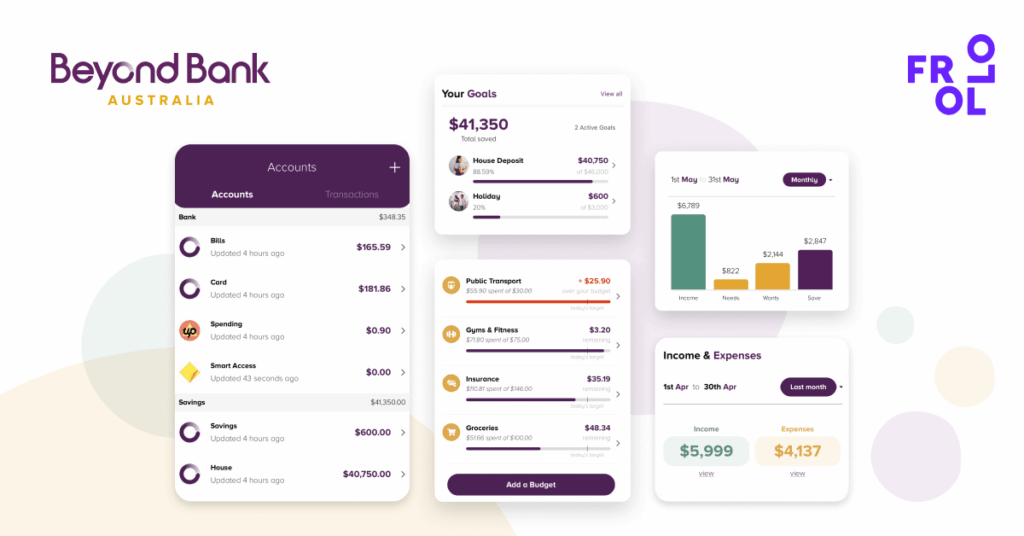

Beyond Bank was early to recognise the potential value this could deliver for its customers and became the first bank to launch a Personal Financial Management app using Open Banking data. The Beyond Bank+ app launched in July 2022 and provides customers with a full view of their finances in one place, including accounts they hold with other financial institutions.

What are the key benefits of Open Banking for Beyond Bank customers?

Open Banking provides a range of benefits to Beyond Bank customers. First and foremost, customers have visibility and control over what data is shared between financial institutions, and how the data will be used.

In the Beyond Bank+ app, Open Banking data powers the easy-to-use budgeting tools that help customers track and plan their spending.

Though, the potential reaches further than financial well-being and money management, as lending and credit card applications will be faster and easier using Open Banking.