Open Banking is accelerating the future of finance, creating a world where consumers control their data, businesses innovate faster, and competition drives better outcomes.

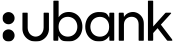

Australia’s CDR in action

Banking was the first sector to launch as part of the Consumer Data Right (CDR) on 1 July 2020. Just as in the UK and other countries, in Australia, this is commonly referred to as Open Banking.

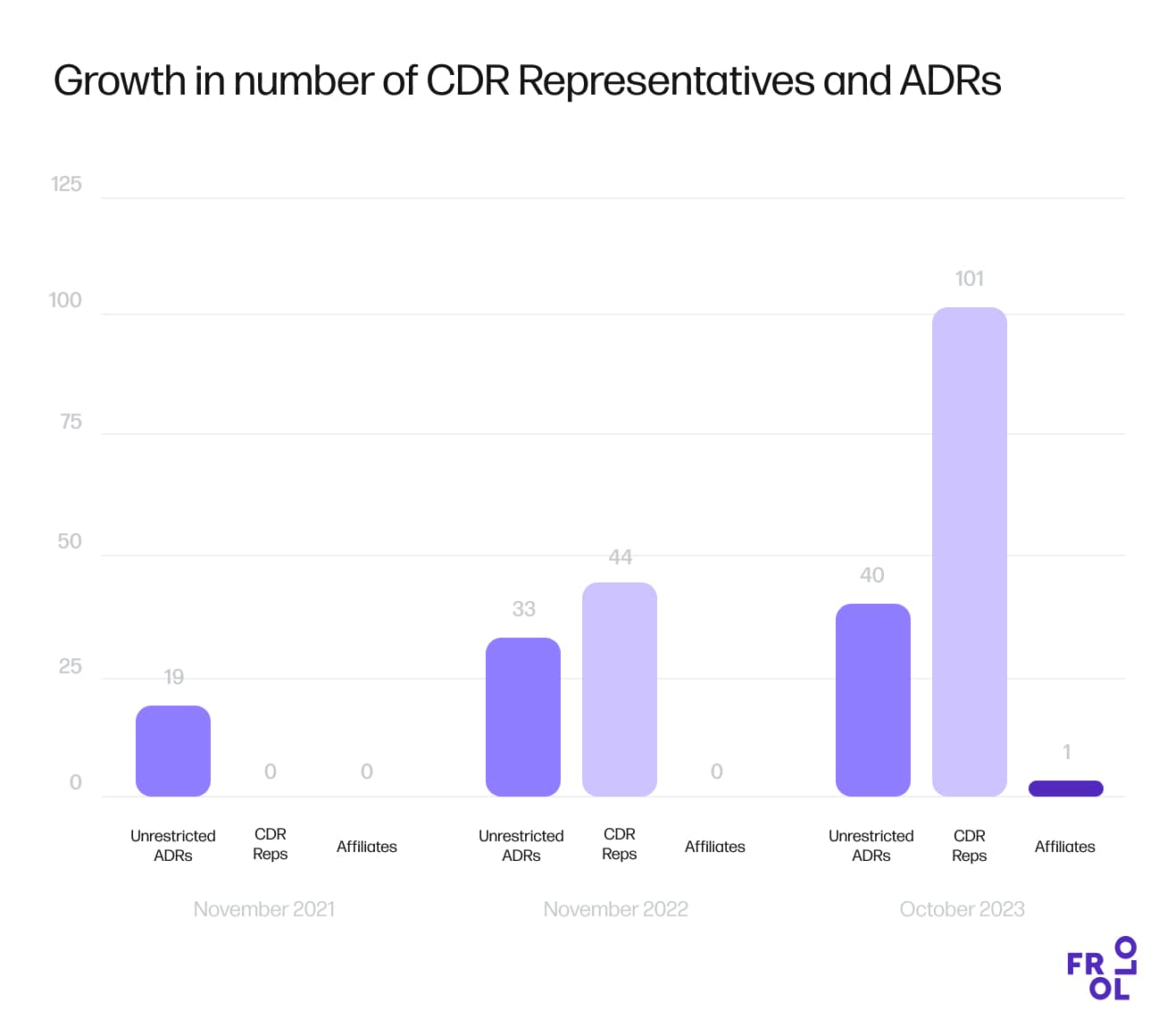

The Consumer Data Right (CDR) puts consumers in control of their data, by giving them the right to share their data between service providers of their choosing. More than 110 banks currently make it possible for their customers to share financial data with third-party providers.