Better, more efficient testing

Take control of your Data Holder compliance with the tools to conduct comprehensive testing across UAT and production whenever you need, with the click of a button. Be confident in compliance with the support of Australia’s most experienced Open Banking engineers.

Better, more efficient testing

Take control of your Data Holder compliance with the tools to conduct comprehensive testing across UAT and production whenever you need, with the click of a button. Be confident in compliance with the support of Australia’s most experienced Open Banking engineers.

-

AutomatedAutomated test case execution with results and evidence.

-

Quality supportSupport by engineers with extensive Data Holder testing experience.

-

Detailed evidenceAll results from tests run on the platform are logged with detailed evidence.

-

EfficientRun tests across UAT & production and raise Jira tickets, all from one portal.

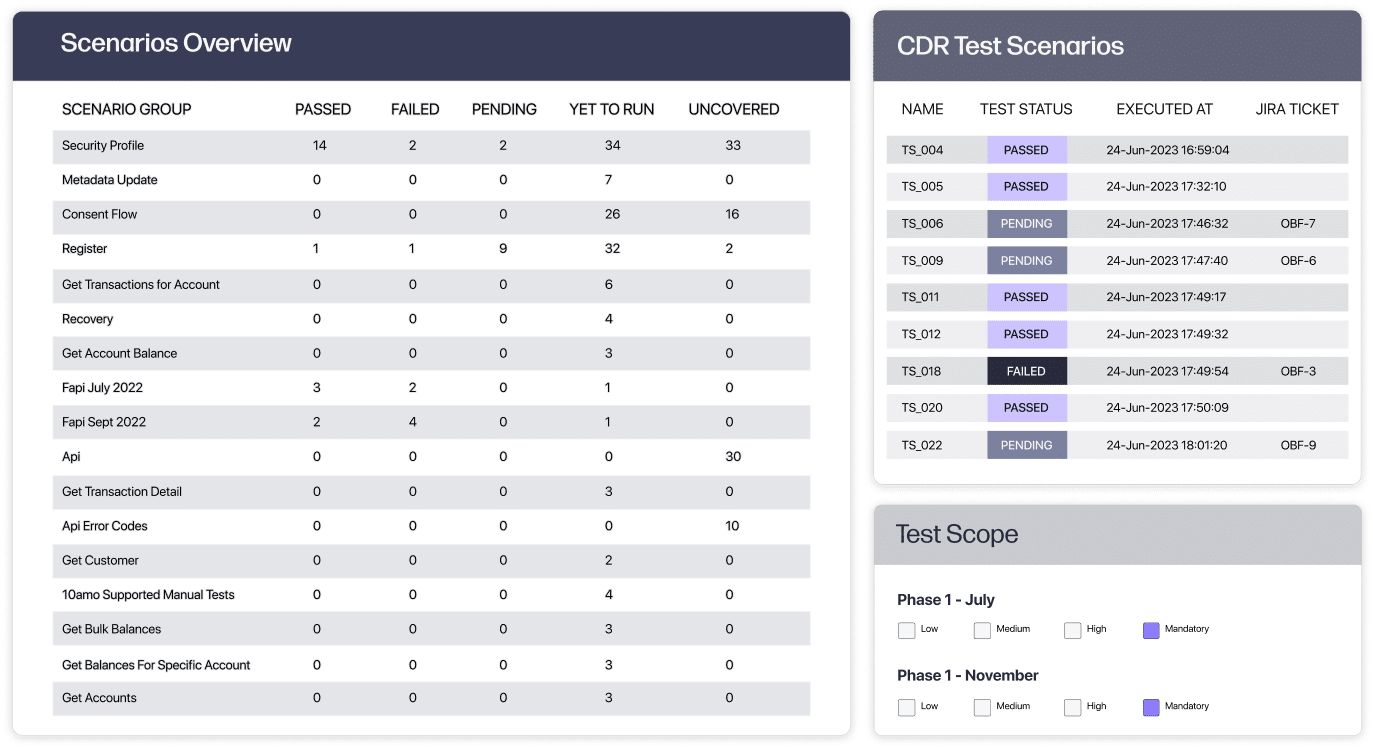

Comprehensive, end-to-end testing

The Frollo Data Holder testing platform is built – and continuously updated – to ensure every aspect of CDR is tested.

-

One platform to test all CDR products and APIs, covering all parts of the CDR specifications. Including: Dynamic client registration, consent management, common and banking API invocation.

-

Testing doesn’t stop with UAT. Frollo’s platform enables you to run a set of test scenarios in production, to ensure you’re compliant.

Empowering Better Banking

We believe in the power of Open Banking to make things better: more accessible, more transparent, and more efficient. Frollo is helping Australia bank smarter, not harder.

Our mission is to empower the financial sector with the Open Banking tools and tech it needs to make the move to a world of better, more open, banking. In this world, customers can share their data freely and securely, positively impacting everyone along the way.

We are

-

Australia's leading Open Banking providerWe’ve been empowering banks, lenders, brokers and financial advisers with Open Data since 2020.

-

Delivering business outcomesOur technology helps clients save time, reduce costs, lower risks and improve customer love.

-

Making finance better for allOur technology makes life better for the millions of Australians our clients serve.