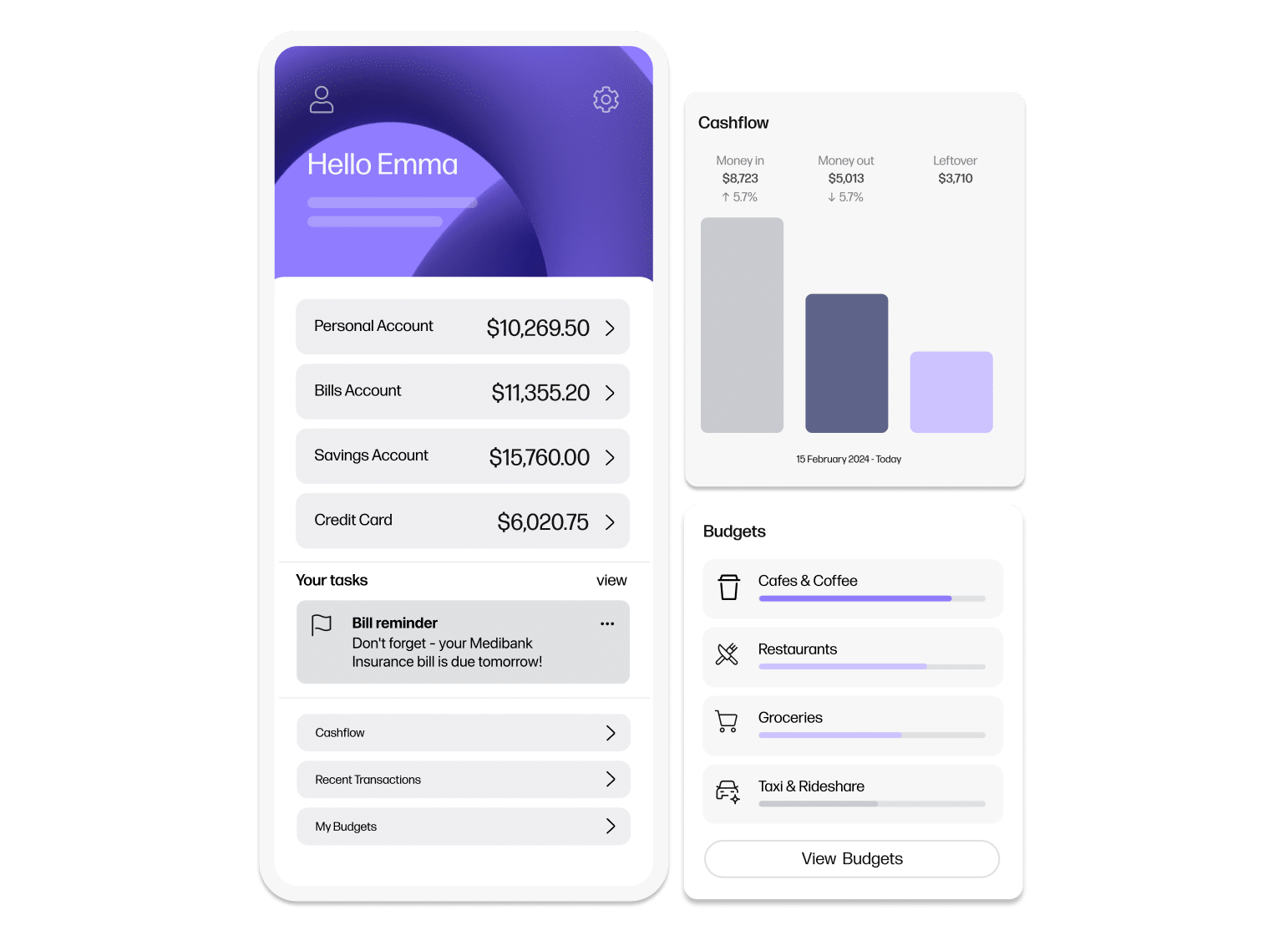

Helping people feel good about money

Whether you’re saving for a house deposit, paying down a debt or just trying to stay on top of your finances: The Frollo app helps you achieve your financial goals.

All of your finances in one app, smart financial insights and the tools to make budgeting a breeze.

And best of all? The app is completely free.

Download the app

-

See the full picture

All your accounts in one place, updated in real time. -

See where your money is going

Set budgets by category and track what you spend. -

Improve your finances

Get smart insights, set budgets and achieve your financial goals.

This is where money gets good

To help you feel good about money, we’ve equipped our app with all the benefits of Open Banking in one place.

-

Automatic categoriesWe’ll automatically categorise your spend so it’s easy for you to see where your money is going.Smart insightsGet ahead with insights from your customisable dashboard. Choose the information you want to see and the order in which it appears.BudgetingSet up a budget in minutes and match to your pay cycle. We’ll track your progress so you’re always on top of your finances.Automatic goal trackingSet multiple goals, link them to an account and automatically track your progress.Net worthStrengthen your financial position by seeing the full value of all your assets and liabilities in one easy to read dashboard.Automatic bill trackingOur bill tracker automatically finds your bills and lets you know when they’re coming up, so they don’t surprise you.