Open Banking API performance

On this page you can find API performance of Open Banking data holders (speed and reliability) based on data from Australia’s most experienced CDR intermediary.

Tracking performance

We’ve been tracking the speed and reliability of Open Banking APIs since 2021. More recently, we’ve started measuring consent conversion, as the ticket to get access to CDR data is the consent.

As the Consumer Data Right is evolving, transparency about performance builds trust and enables businesses to confidently launch their Open Banking powered use cases.

As Australia’s most experienced Open Banking provider, we’re taking responsibility in providing this transparency and helping grow the ecosystem.

To do this, we’re using data from the Frollo consumer app, which has made more than 200 Million Open Banking API calls in production to date.

API speed and reliability

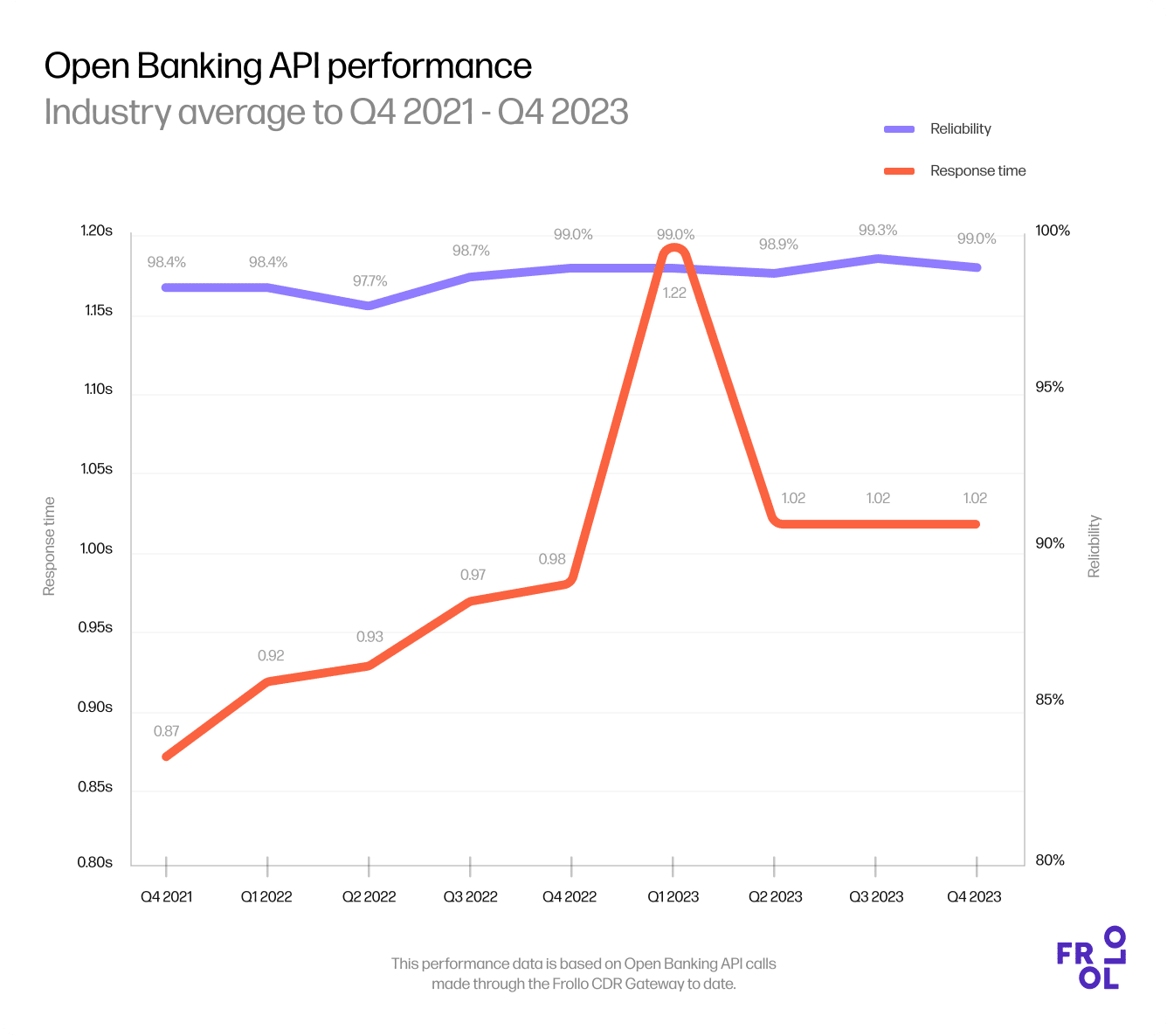

This graph shows how the speed and reliability of Open Banking API connections have developed over time.

We’ve included the following APIs:

- Transactions for account API: Enables a Data Recipient to request a list of transactions for a specific account

- Accounts API: Provides basic information for a specific account, such as product category and account status

- Bulk balances API: Provides balances for multiple, filtered accounts

- Account details API: Provides detailed account information, including product information

The graph shows two metrics over time:

- API speed: The average, end-to-end production response time of these APIs across all Data Holders

- Reliability: The percentage of production calls to these APIs that was successful across all Data Holders

Open Banking consent conversion

A data sharing consent in the CDR is the ticket to access financial information. Speed and reliability don’t matter much if a consent can’t be established.

This graph shows the percentage of consent attempts that don’t succeed on the Data Holder side, after the consent has been collected in the Frollo app (Data Recipient).

The 10 banks in this list are the ones with the highest number of consent attempts.

Empowering Better Banking

We believe in the power of Open Banking to make things better: more accessible, more transparent, and more efficient. Frollo is helping Australia bank smarter, not harder.

Our mission is to empower the financial sector with the Open Banking tools and tech it needs to make the move to a world of better, more open, banking. In this world, customers can share their data freely and securely, positively impacting everyone along the way.

We are

-

Australia's leading Open Banking providerWe’ve been empowering banks, lenders, brokers and financial advisers with Open Data since 2020.

-

Delivering business outcomesOur technology helps clients save time, reduce costs, lower risks and improve customer love.

-

Making finance better for allOur technology makes life better for the millions of Australians our clients serve.