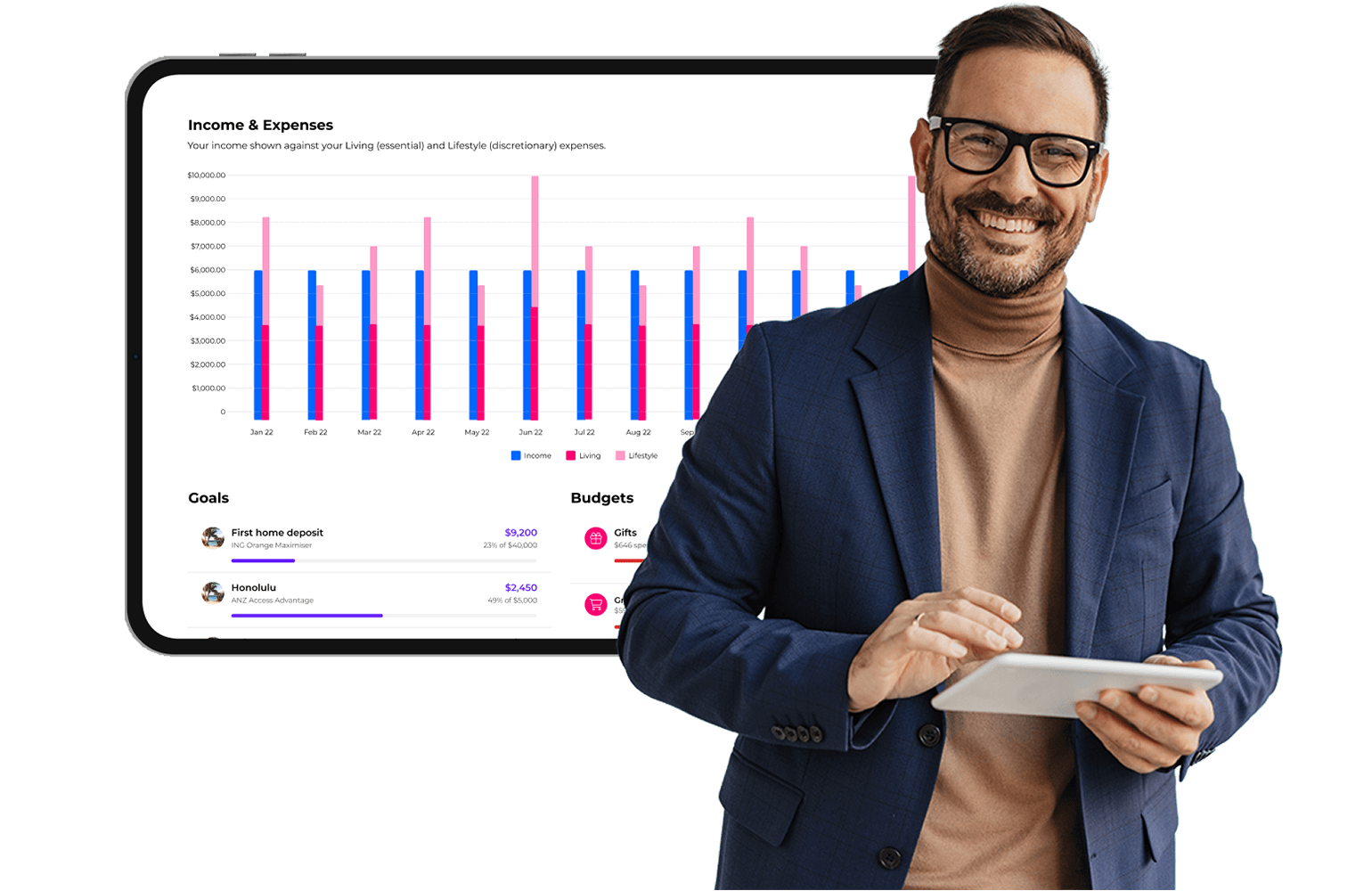

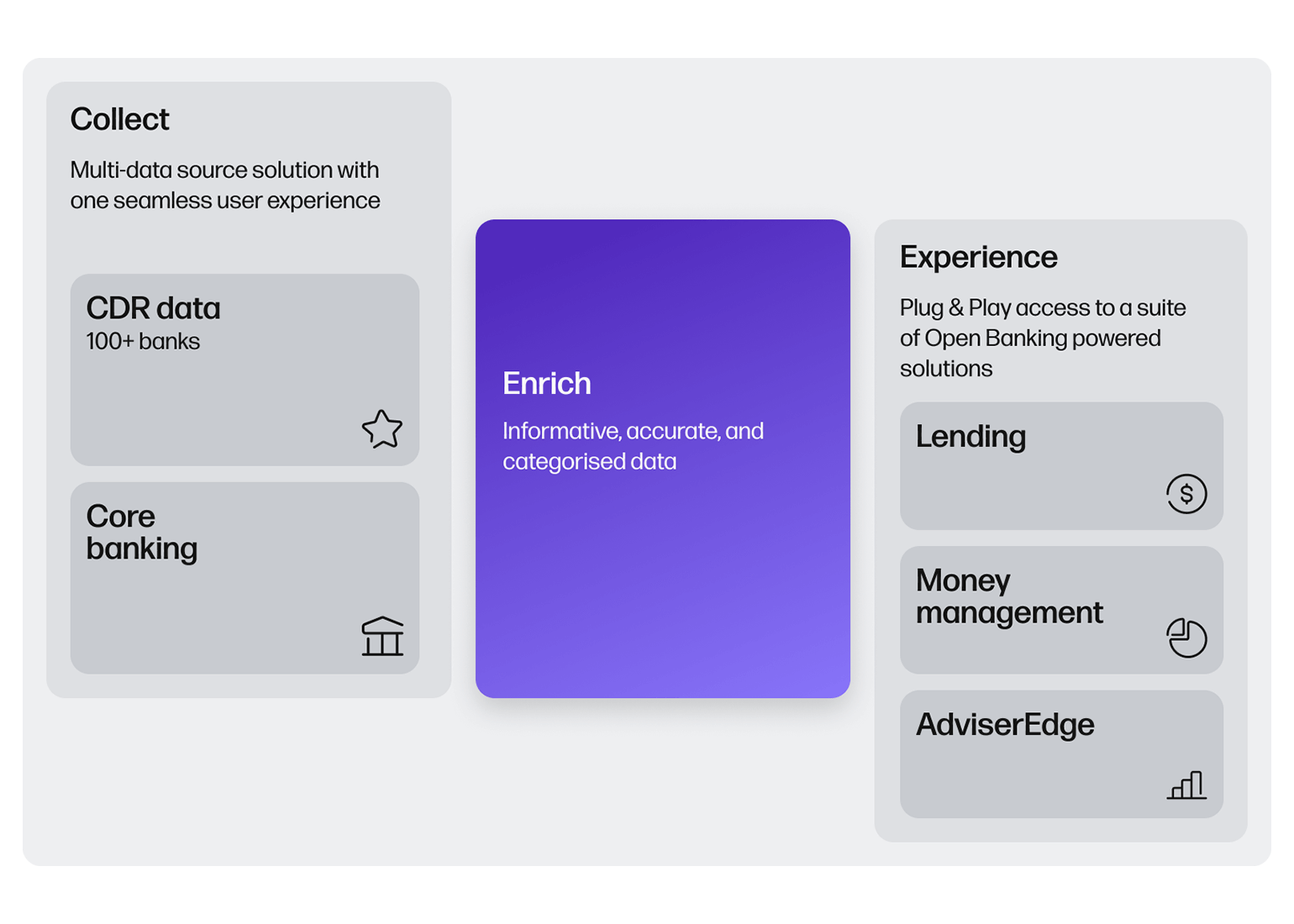

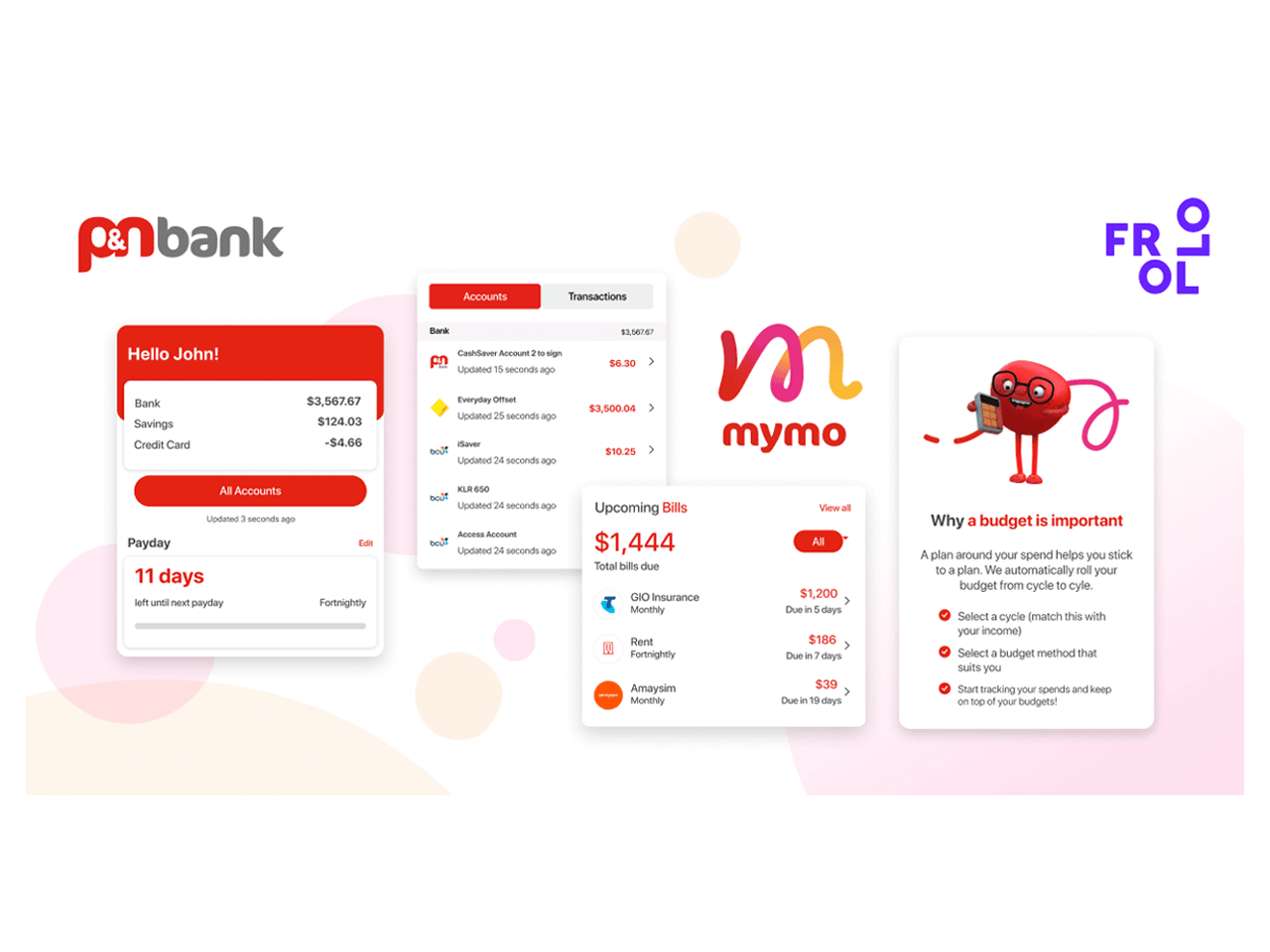

As Australia’s leading Open Banking provider, we’re delivering businesses and mortgage brokers efficiency tools and exceptional customer experiences and empowering consumers to achieve their financial goals.

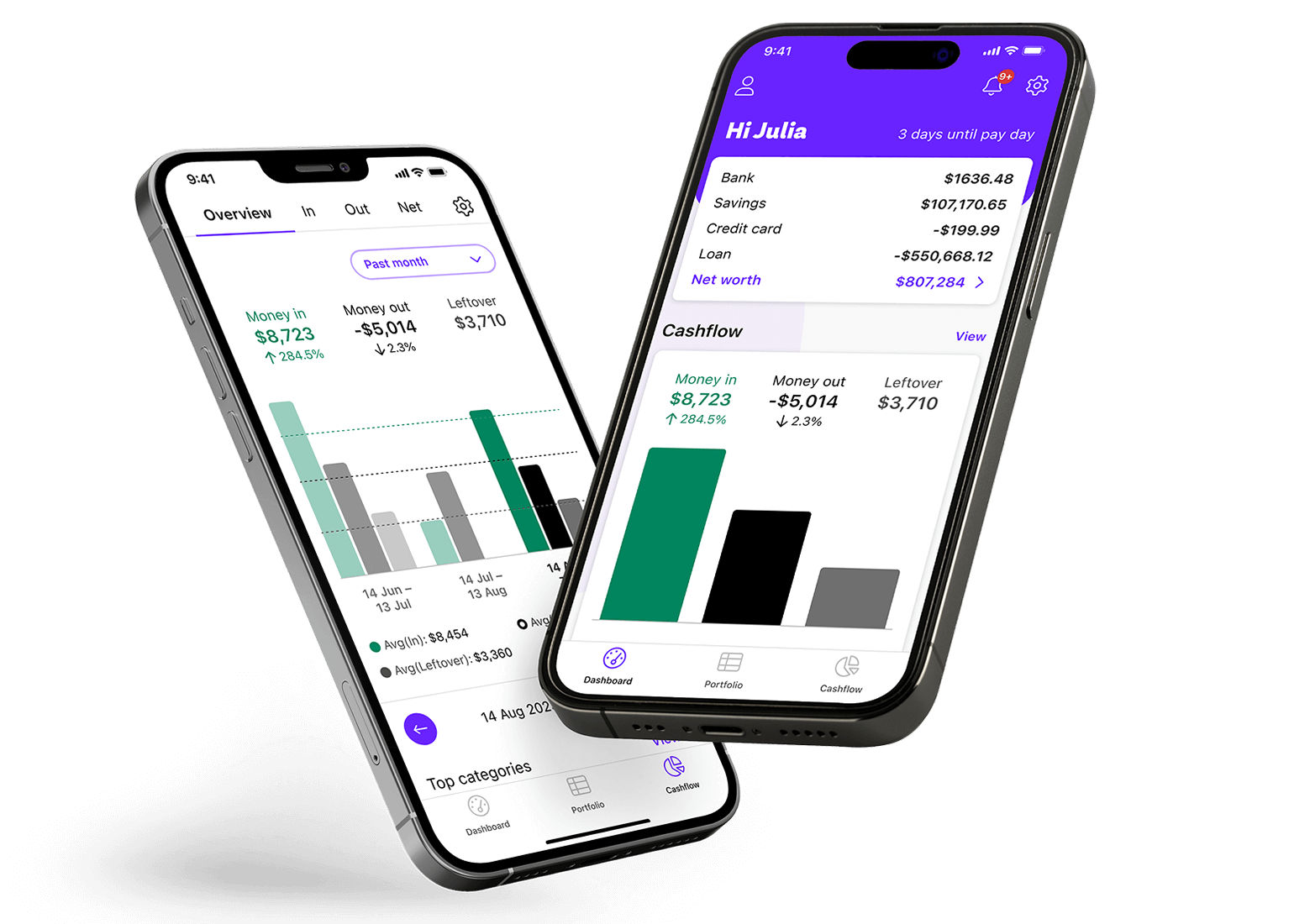

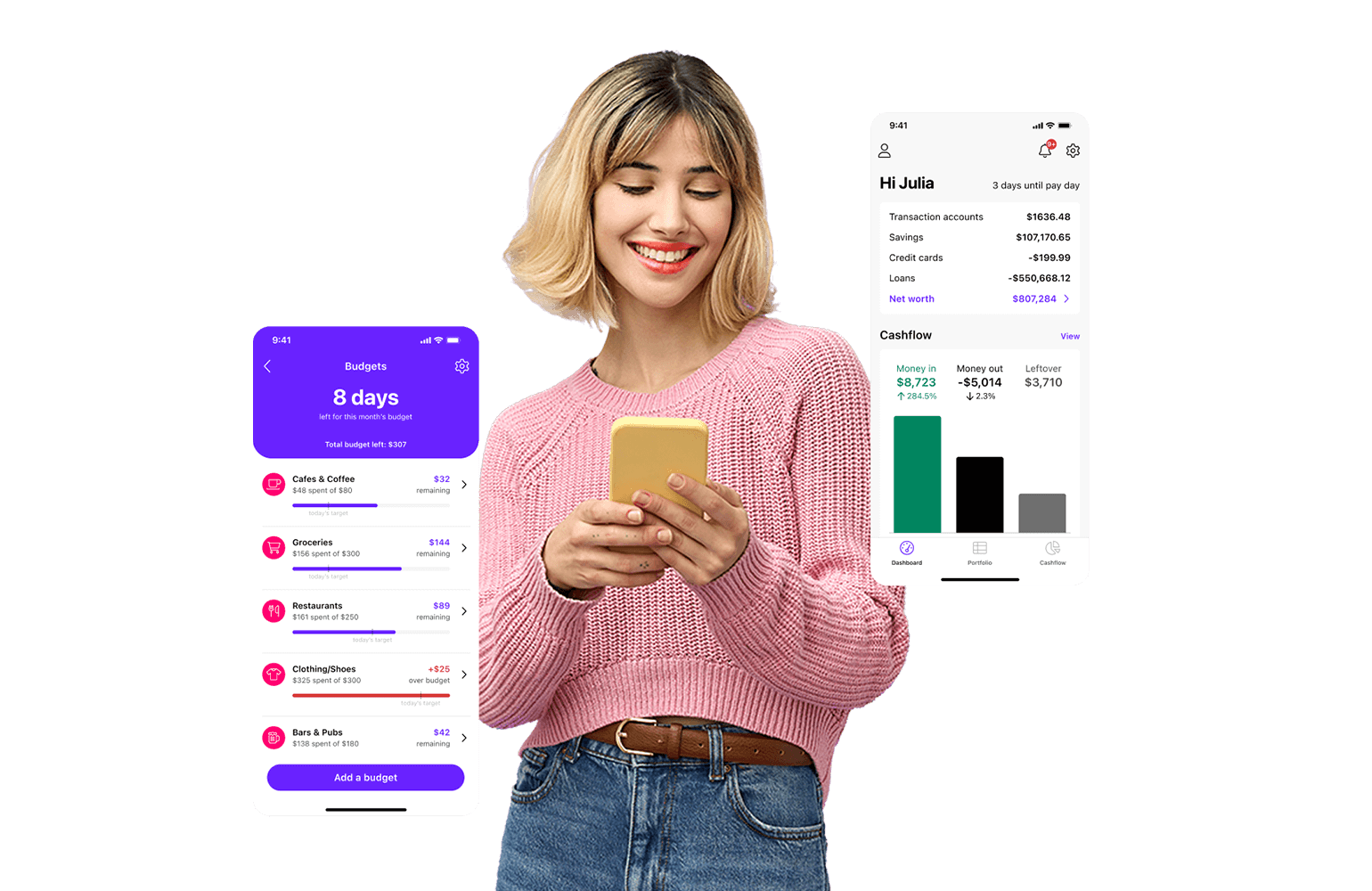

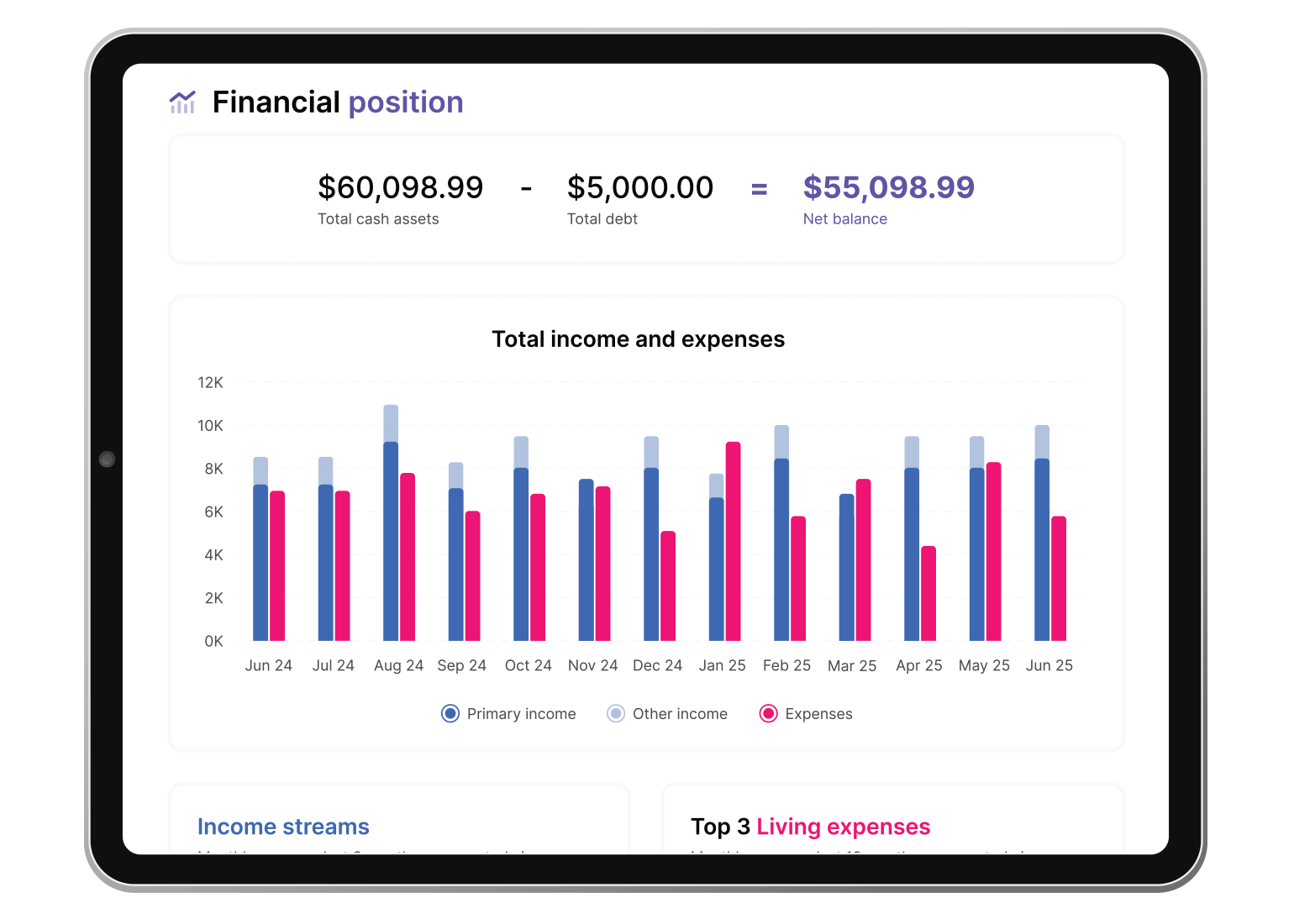

Feel good about money

We’ve built the simplest way to turn around your finances and help you get ahead. Download our free money management app and shift the balance.