Product Reference Data

Turn Product Reference Data into a competitive advantage.

-

Save time

Quickly and efficiently manage your product data APIs. -

Stay compliant

Your APIs are automatically upgraded to the latest specs to remain compliant. -

Gain market insights

Track and analyse competitor product data to inform product and marketing decisions.

Compliance made easy

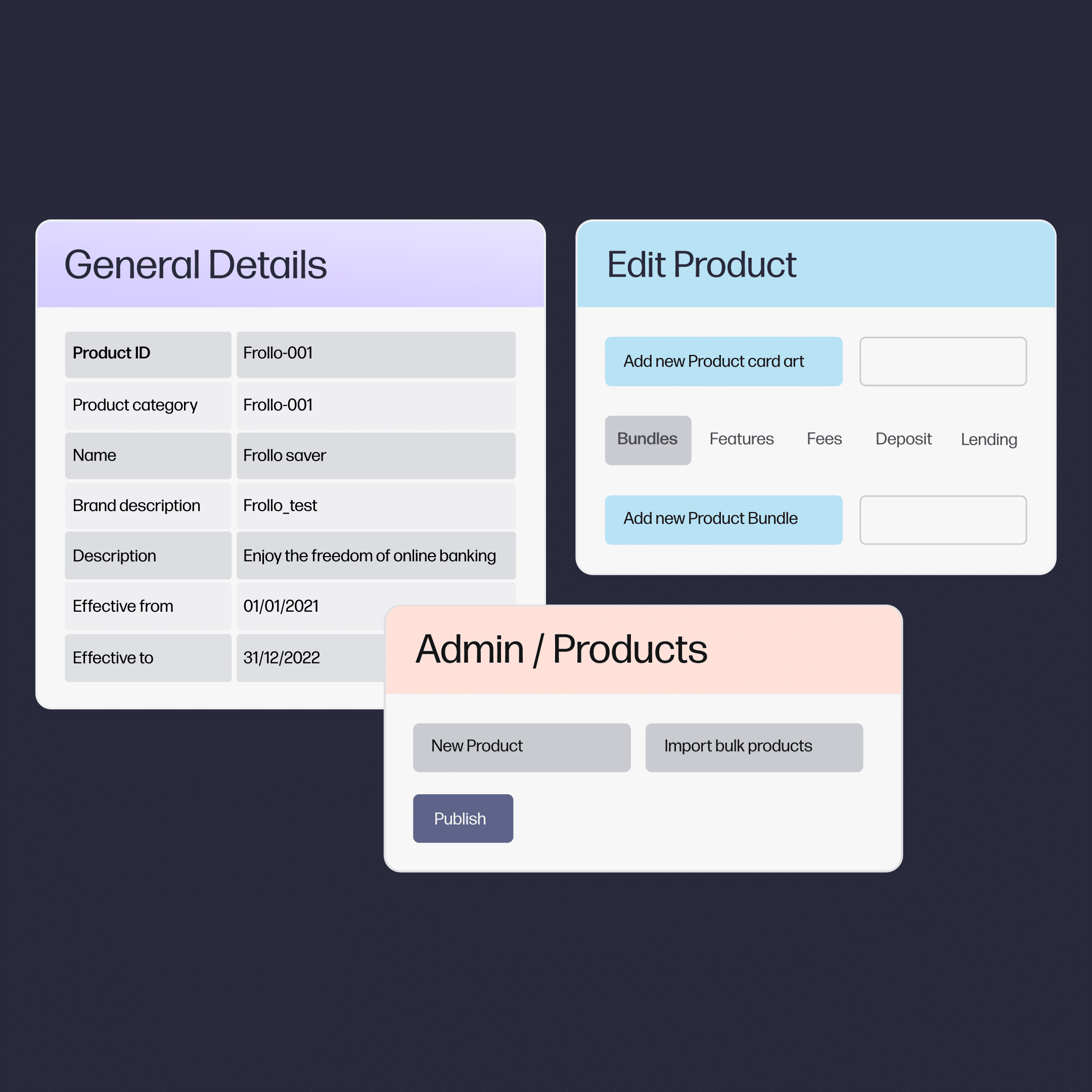

One portal to Comply and Compete

Product Reference Data in the Consumer Data Right is more than a compliance obligation, it’s an opportunity to gain a competitive advantage. Our PRD Portal consists of two modules, to Comply and Compete.

-

Our product management portal enables you to create, update and schedule changes to products easily. Bulk upload and download products, or edit them individually in the portal.

-

Track market trends and stay on top of product changes with our competitive analysis, covering over 7,500 products in real-time.

Empowering Better Banking

We believe in the power of Open Banking to make things better: more accessible, more transparent, and more efficient. Frollo is helping Australia bank smarter, not harder.

Our mission is to empower the financial sector with the Open Banking tools and tech it needs to make the move to a world of better, more open, banking. In this world, customers can share their data freely and securely, positively impacting everyone along the way.

We are

-

Australia's leading Open Banking providerWe’ve been empowering banks, lenders, brokers and financial advisers with Open Data since 2020.

-

Delivering business outcomesOur technology helps clients save time, reduce costs, lower risks and improve customer love.

-

Making finance better for allOur technology makes life better for the millions of Australians our clients serve.

Latest

Frollo

Updates

Our purpose Empowering the finance ecosystem with the technology to unlock an Open Data world is driven by our passion of making finance better for all and through our process of developing Australia’s leading Open Data technology.