P&N Bank, a division of P&N Group, is today among the first banks in Australia to launch a new personal financial empowerment tool – mymo by P&N Bank – to its customers under the Australian Government’s Consumer Data Right (CDR) Scheme as part of Open Banking.

P&N is at the forefront of delivering real customer value through Open Banking technology, and as a purpose-driven business, we’re excited to be the partner to help them do this.

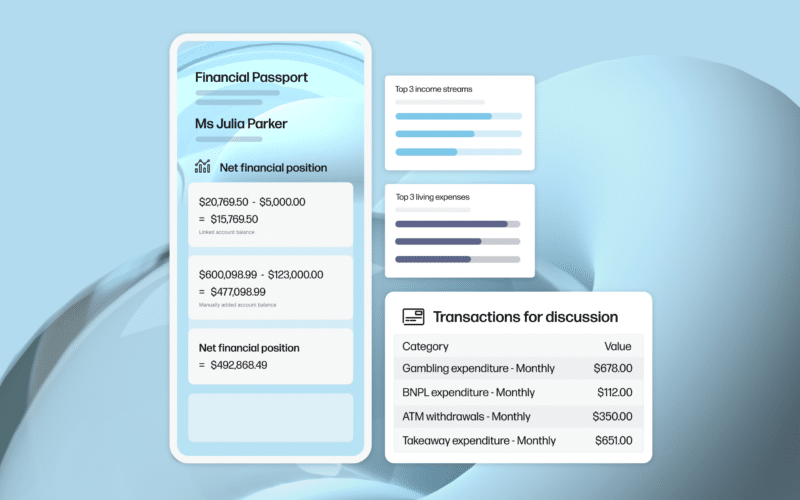

Through the mymo app, P&N customers will have access to a range of powerful money management and financial well-being tools powered by Frollo’s Money Management Platform. And we know from our own experience that, on average, customers using these tools:

- reduce their credit card debt by 13% in the first six months

- reduce their personal loan debt by 23% in the first six months

- increase their savings by 11% in the first three months.

Say hello to mymo

The new companion app will offer P&N customers greater financial empowerment and a superior experience, complementing the bank’s existing suite of digital tools. It will also allow P&N bank to build personalised member relationships and value- adds through rich data.

To drive momentum, P&N has leveraged data insights to identify and engage a group of approximately 13,000 customers most likely to be fast adopters of their new mymo app. The launch targeted digitally active customers, including regular users of Internet Banking, P&N’s mobile app and digital wallets, as well as customers that are deemed active savers or active spenders.

The mymo by P&N Bank app is the perfect tool to make life easier for our customers, by placing control of their overall financial situation and wellbeing in their hands.

Angela Newland, General Manager (P&N Bank)

General Manager P&N Bank, Angela Newland, said Open Banking and P&N’s new mymo companion app were game changers for the banking industry and customers alike, especially with the increasing cost of living pressures.

“We know many households are feeling the pinch of higher inflation and low wage growth, so for many, having a clear budget and savings plan has become more important than ever,” Ms Newland said.

“Through research conducted by P&N Bank with Painted Dog, we discovered that 84% of P&N customers place a high priority on improving their financial well-being. It’s also interesting to note that 15% of P&N customers and 33% of the general Perth population lack the money to support bill or loan commitments at the final reminder stage.

“The mymo by P&N Bank app is the perfect tool to make life easier for our customers, by placing control of their overall financial situation and well-being in their hands. The app centralises a customer’s transactional data across all their accredited financial institutions and provides them with control of their sharing consent, plus it’s safe and secure, the same as P&N’s mobile banking app.

“Our customers will be able to make mymo their own through personalisation, including reorganising transactions categories, because it’s their money, used and spent their way. They can also keep better track of their spending and budgeting to achieve financial empowerment.

“Consumer trust will be a key element in the take-up of this new way of banking, and that’s why we’ve partnered with trusted organisation, Frollo, to deliver an Open Banking solution that ensures customers can safely and securely share and manage their data and information.”

“As a purpose-driven fintech, we’re thrilled to support P&N in helping its customers better manage their money and improve their financial wellbeing.”

Tony Thrassis, CEO (Frollo)

Frollo CEO Tony Thrassis said they are excited that P&N Bank is launching the mymo app, using Open Banking to financially empower their customers. “As one of the first banks in Australia to make use of Open Banking, they’re showing real vision and leadership; and it’s no surprise that a customer-owned bank has its customers in front of mind,” Mr Thrassis said.

“As a purpose-driven fintech, we’re thrilled to support P&N in helping its customers better manage their money and improve their financial well-being.”