Uncovering Australians’ interest in, and concerns with Open Banking powered products and services.

The consumer perspective

Open Banking in Australia is ready for take-off. At least, that’s what the industry thinks. After a few years of laying the pipes and setting the groundwork, most businesses are planning to start offering Open Banking powered experiences this year.

But what about consumers? How do they feel about being in control of their data? Do they share the excitement about these new products and services?

We surveyed a group of 1,066 people representing the Australian population (18+) to find out.

How do Australians feel about Open Banking?

The report focuses on answering three key questions:

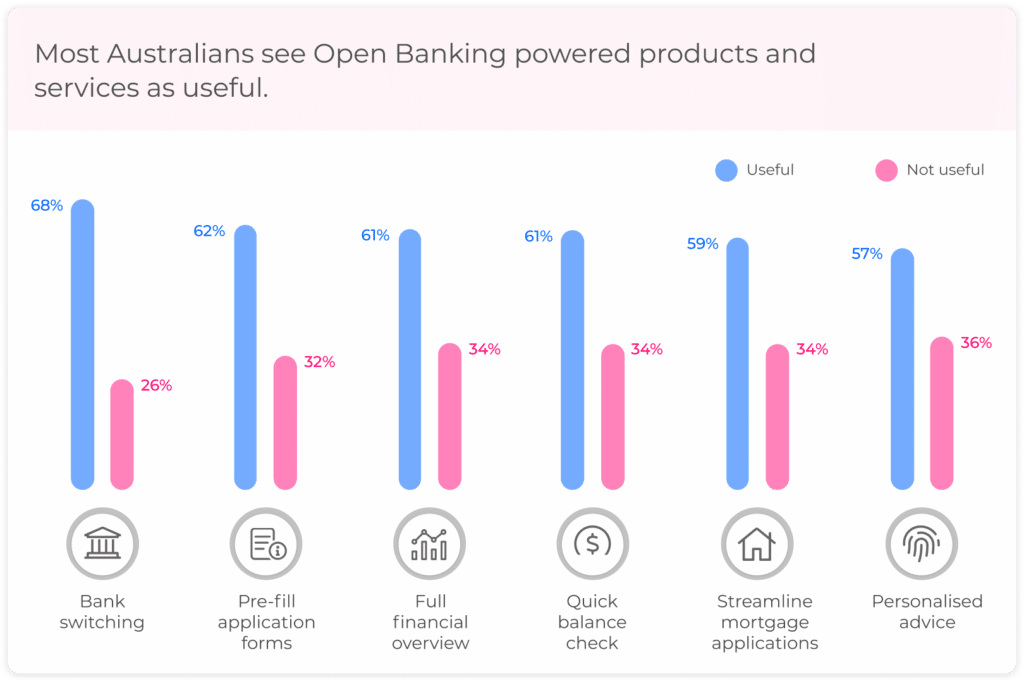

- Which Open Banking use cases are most valuable to consumers?

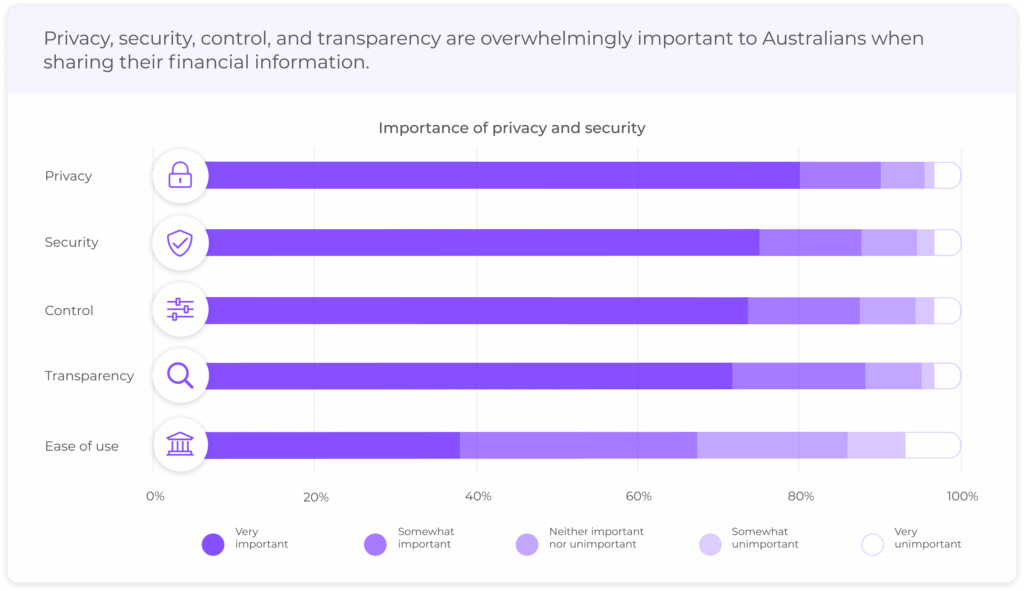

- What are their biggest concerns when it comes to sharing financial data?

- Who do they trust with their financial data?

Key consumer insights

- Australians want Open Banking-powered products and services

- Consumers value the privacy and security Open Banking offers

- Trust has to be built

- Millennials and Gen Z are likely the first to get on board

Driving Open Banking success

The opportunity to deliver innovative, personalised products and services with Open Banking is enormous, but it requires its own approach.

The report includes a range of recommendations to set you up for success in your Open Banking journey.

Download the report