Built to drive lending efficiency

A complete set of lending tools

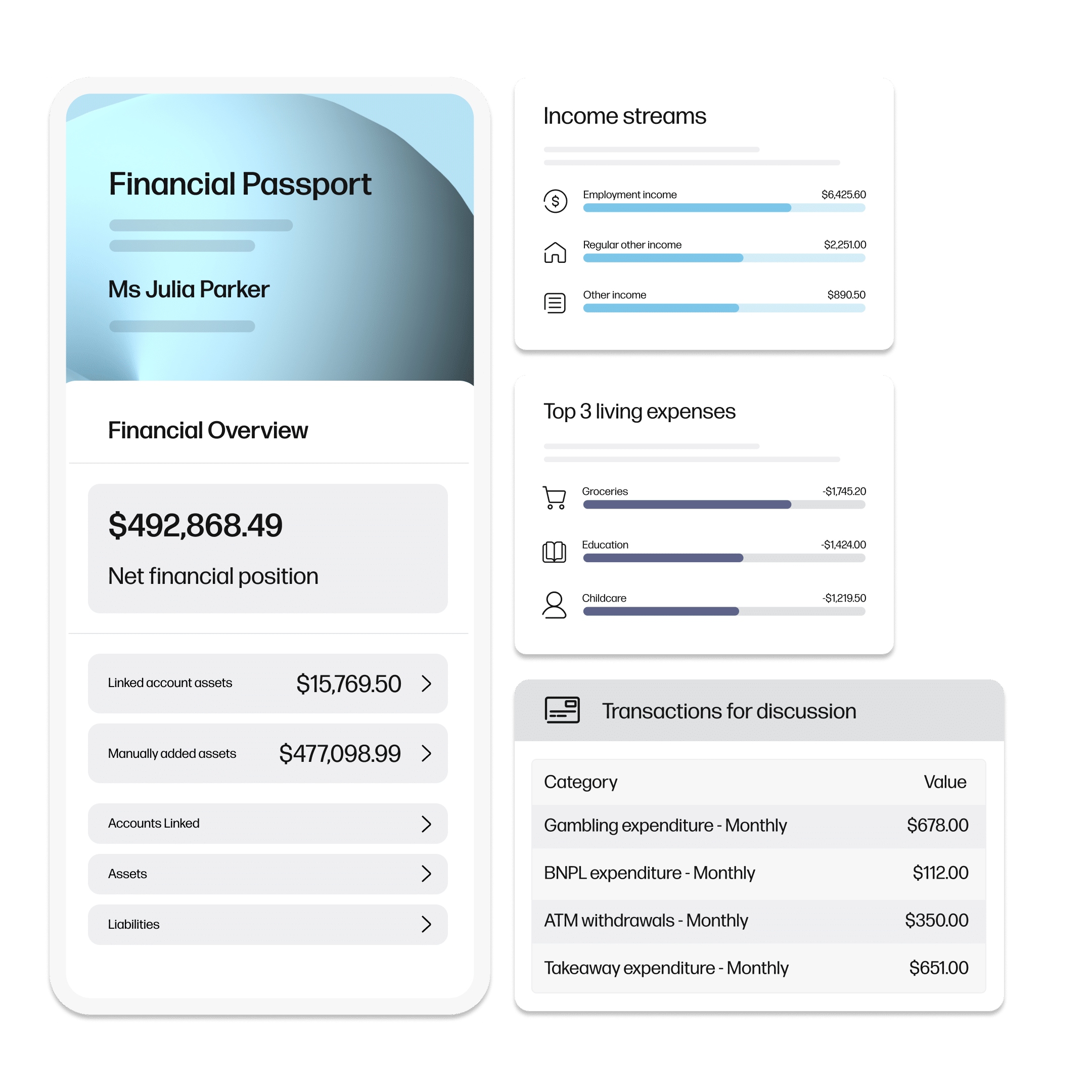

The Financial Passport solution is a complete set of tools to help you streamline your lending process.

-

The Financial Passport PDF is an easy to read snapshot of your customer’s finances, including income, expenses, assets and liabilities. It can be customised to include risk metrics, unusual transactions and more.

-

The Financial Passport API connects directly with your lending CRM to auto-populate applications with CDR data, saving you time and providing you with one single source of truth.

-

CDR Bank statements are automatically generated using bank verified data, for use in any credit application.

-

The Partner Portal is an online environment where you can access your customer’s financial profile.

Empowering Better Banking

We believe in the power of Open Banking to make things better: more accessible, more transparent, and more efficient. Frollo is helping Australia bank smarter, not harder.

Our mission is to empower the financial sector with the Open Banking tools and tech it needs to make the move to a world of better, more open, banking. In this world, customers can share their data freely and securely, positively impacting everyone along the way.

We are

-

Australia's leading Open Banking providerWe’ve been empowering banks, lenders, brokers and financial advisers with Open Data since 2020.

-

Delivering business outcomesOur technology helps clients save time, reduce costs, lower risks and improve customer love.

-

Making finance better for allOur technology makes life better for the millions of Australians our clients serve.

Latest

Frollo

Updates

Our purpose Empowering the finance ecosystem with the technology to unlock an Open Data world is driven by our passion of making finance better for all and through our process of developing Australia’s leading Open Data technology.